Managing the Ripple Effect: The Global Telecom Environment and New US Tariffs

Analysts

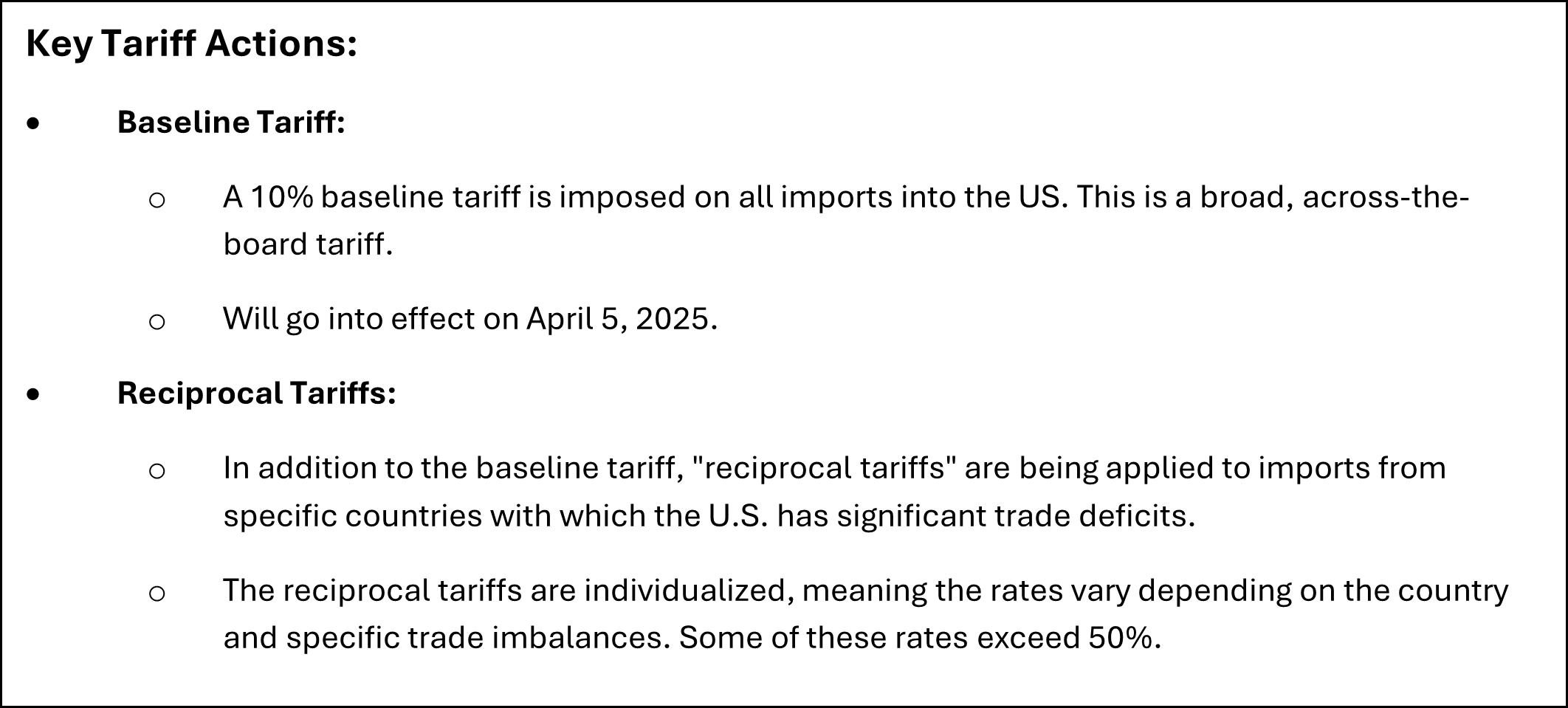

Ray MotaNowhere is the delicate balance of the global economy more evident than in the intricately linked telecoms industry. The industry is being affected by new US tariffs on imported items, which will include vital telecom components and equipment. At ACG Research, we're carefully examining the effects on domestic and international equipment suppliers as well as the service providers who create and run the networks that are essential to our digital world.

In essence, tariffs are a weapon for trade policy, frequently used to safeguard homegrown businesses, correct trade imbalances or apply geopolitical pressure. However, the effects are rarely simple and frequently result in a complicated web of intended and unexpected repercussions, especially in an industry as globally integrated as telecommunications.

Effect on American Equipment Suppliers

New tariffs on overseas competitors may at first appear to be beneficial for US based telecom equipment producers. Because imported equipment is more expensive, domestically made alternatives may become more affordable, which could boost their market share in the US. This is in line with initiatives to support homegrown manufacturing and technological innovation.

Truth Is More Complex

- Complexity of the Supply Chain: Many US vendors depend on international supply chains, sourcing parts from several nations, including those that might be subject to tariffs or retaliatory tariffs. Any competitive advantage obtained from tariffs on completed imported items may be offset by higher prices for these necessary components, which would ultimately result in higher production costs.

- Retaliation Risk: Affected countries frequently take retaliatory action in response to tariffs. New tariffs may be imposed on US vendors exporting their goods overseas, reducing their addressable market and affecting international revenue streams.

- Innovation & Cost: As competition declines, local players may eventually feel less incentive to innovate quickly and optimize costs. Moreover, tariffs may reduce service providers' demand if they dramatically increase the total cost of network equipment.

Effect on International Equipment Suppliers

Foreign vendors face formidable obstacles, especially those that depend significantly on the US market (such as big players from Europe and Asia):

- Increased Landing Cost: Tariffs make equipment less competitive as compared to domestic alternatives or suppliers from nontariff nations by directly raising the cost of selling it in the US market.

- Market Share Erosion: Procurement tactics may be shifted toward less expensive (or nontariff) options by service providers, particularly those that are sensitive to CapEx. This could result in a loss of market share for long-standing foreign vendors.

- Strategic Re-evaluation: Some vendors may need to reconsider their approach to the US market. Options include relocating manufacturing/assembly operations, passing costs on to customers (risking competitiveness), absorbing the tariff expenses (affecting margins) or concentrating R&D and sales efforts on other international regions.

Effect on Service Suppliers

The main users of network equipment are telecom service providers, which include carriers, MSOs, and cloud providers. Their business strategies are directly impacted by tariffs on this equipment:

- Increased CapEx: Tariffs increase the price of critical infrastructure, including switches, routers, optical equipment, and RAN equipment. This raises the amount of money needed for regular updates and network rollouts (such 5G expansion and fiber-to-the-home).

- Deployment Delays:Network deployment timelines may be delayed by increased expenses and possible supply chain interruptions brought on by changing trade dynamics. Customers' and enterprises' access to next-generation services may be delayed as a result.

- Pressure on Vendor Diversification: Although the tariff situation may be expensive, it may hasten operators' plans to diversify their pool of vendors in order to reduce the risks associated with any one supplier or nation of origin.

- Possible Cost Pass-Through: Long-term increases in network expenses may eventually result in higher service costs for end customers; however, competitive constraints may restrict this.

The Wider Ecosystem: Unpredictability and Adjustment

Tariffs create uncertainty in the global telecom ecosystem in addition to their direct effects on these participants. They can affect worldwide R&D investment patterns, potentially disrupt supply chains, and make international standard-setting collaboration more difficult. Although there would be substantial transition costs and complications, the long-term impacts might include a tendency toward near-shoring or reshoring for manufacturing.

ACG Research Viewpoint

Although new US tariffs might provide some protection for domestic production, the overall impact on US suppliers is far from assuredly favorable due to the interconnectedness of supply chains and the possibility of reprisal. It will be difficult for foreign sellers to remain competitive in the US market. Importantly, rising equipment costs are projected to fall mostly on service providers, which could affect the economics and speed of the construction of critical network infrastructure.

It takes strategic foresight to navigate the new US tariffs. Vendors need to assess the weaknesses in their supply chains and look at ways to strengthen them. In addition to stepping up efforts to diversify their vendors and strengthen their supply chains, service providers must account for possible delays and cost increases in their planning.

We'll keep an eye on the changing situation because we know that the full impact will become apparent over time and be influenced by particular tariff details, retaliatory measures, and industry-wide adaptation plans. Additionally, many service providers are already facing margin constraints and slowing growth in core connection revenue at the same time as this impact on CapEx. To mitigate tariff effects and safeguard revenue in this setting, operators will need to strategically apply AI for network optimization, predictive maintenance, and operational efficiency. Adaptation is definitely required as things change.

To discuss this issue with Ray Mota, contact him at rmota@acgcc.com