NEWS

Ten takeaways from MWC Americas 2018: Not exactly a repeat of last year

Fresh off of the second annual Mobile World Congress Americas, held this year in LA (and for the next few years apparently), here are my insights from the meetings, conferences and panels I attended and moderated at the show. I don’t tend to pay a lot of attention to attendance at these events; I look for what events people are attending rather than just how many are attending.

For comparison, here is the link to my 2017 blog from MWC Americas 2017. https://www.acgcc.com/5g-continues-to-dominate-10-takeaways-from-mobile-world-congress-americas/

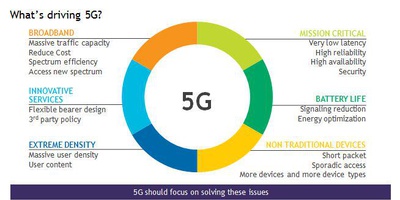

5G clearly dominated the event this year, and that is not necessarily a good thing: there is still much to be done to actually bring 5G to market in a big way this year, and it overshadowed advances in small cells, actual MEC applications and usage, and the ongoing densification and performance improvements in LTE and IoT. The following are my takeaways:

1. 5G business models continue to lag, but the use-cases being discussed are narrowing or at least rolling out over a more realistic timeline. Much of the focus seems to be on wide area networks, and a specific use-case most of which are both indoors and outdoors. However, indoor coverage itself was not as big a focus as I would have expected (excluding stadiums, arenas and airports on which Nokia, CommScope, Boingo and others are very much focused).

2. There isn’t a real race to 5G. Whether or not China or the US or South Korea or Japan or (insert your favorite country here) is first to deploy 5G, it really doesn’t matter in the grand scheme of things. Why? Because each country has its own requirements for the service and 5G is so broad that being first in one area, say Fixed Wireless Access, does not automatically translate into leadership in other areas such as eMBB, URLLC or the many flavors of IoT (see below). That and SKT being first with 5G in South Korea, for example, isn’t taking customers away from Verizon in the US. Let’s stop with handing out meaningless first trophies please. Firs’ does not mean Best or even Most Available.

3. Takeaway from the 5G Conference: 5G represents technology wide enough that the US operators (as well as MNOs around the world) can implement the technology in their own unique way, to their own advantage. To their credit, the 5G CTO panelists resisted saying exactly HOW their 5G gives them a competitive advantage, but we already see 5G deployed as mmWave FWA, low-band mobile, mid-band mobile and combinations. On top of the different strategies relating to 5G Stand Alone and Non-Standalone deployments, how you deploy 5G, unlike 4G, can be a competitive differentiator.

4. Multi-Access Edge Computing was barely a sideshow at the conference despite a key announcement from Ericsson (Full Disclosure: I was briefed on their Enhanced Radio System and RAN Compute announcement and quoted in their PR) and Juniper. This was forecasted by a small survey I did before MWC where MEC received no votes as a main topic at MWCA. MEC was included in most 5G presentations, including those from Intel, Nokia and discussions I had with vendors such as Cisco and Dell (among others), but despite some references to current uses, not much detail was provided. This needs to get fixed for MWC. Also, the myriad of organizations looking to create or influence standards (ETSI, IEEE, OpenFog, etc.) need to get organized. Right now, there is not a workable standard for an Edge Compute platform, which means Amazon, Microsoft, eBay, Netflix, HBO, etc., could go their own way and that would greatly hinder the Edge Compute market. Dell and HPE, among others, are paying close attention.

5. IoT is badly in need of definition and was a second-tier topic at the event. As has been said, all 5G presentations feature IoT, few IoT presentations feature 5G. The Day 1 Show Daily had the first IoT article on Page 11. Day 2 was better. Confusingly, in three different presentations, a sensor network IoT example was put right up with a robotic control IoT example; two use cases that could not be further apart in cost, complexity or network requirements. And on a personal note, I have a visceral (and negative) reaction to robotic surgery as a 5G/IoT use case.

6. LTE has a LOT of life left, even if 95% of the focus is on 5G. From the wide area coverage easily afforded by LTE (globally, even if some regions are behind the most advanced regions) to the wide range of technologies and services supported by LTE. It is one of the few technologies that has lived up to its hype (and name, Long Term Evolution) ranging from gigabit LTE to kilobit LTE. Now, it will be the core of the 5G networks well into the 2020s. Operators and vendors need to spend more time talking about how they are making LTE networks stronger, broader and most cost efficient. It is happening, I know it is. Sprint is deploying 64×64 MMIMO antennas on its 2.5GHz spectrum, FINALLY making good use of this valuable asset. I saw 100Mbps in a hotel conference room (!) on my Sprint mobile and 140Mbps via a Magic Box, both connected to one of Sprint’s commercial network MMIMO antennas. New devices such as the iPhones X and the Samsung Galaxy S9 support 4×4 MIMO and LAA. LTE keeps getting stronger.

7. Small cells are living a bifurcated life: Indoor coverage is not getting the universal attention it deserves (or requires) yet vs outdoor coverage. Sprint still leads indoor small cell deployments in the US with its ubiquitous Magic Box with over 260,000 deployed on the way to 1 million and now in three versions from Airspan. (Full disclosure: I am testing a Magic Box, and the Sprint service in my office went from unusable to 20+ MB downloads.) Despite the focus on mmWave spectrum for 5G, indoor solutions for LTE and 5G were not front and center. Small cell vendors such as Airspan and Casa were touting their 5G ready, mmWave and CBRS products, but the story from the larger vendors was mainly about outdoor coverage.

Stadiums and arenas get their play, but the office building, home, shopping mall and campus indoor solutions were not a main story. The small cell story was very much about deployment simplification (for example, Strand Mounts), and at the Nokia event on Tuesday we took a few minutes off to watch an Ericsson small cell being installed for Verizon outside our window. Nicki Palmer, CNO for Verizon, confirmed that there is a 5G small cell installed not far away from the convention center.

8. Wi-Fi may still be untouchable, for now. It was not often brought up in conversations thus Wi-Fi replacement was not a big story at MWC A. This may be due to two reasons: 1. Uncertainly about the impact and timing of the CBRS deployments, device support and business models, and 2. Once CBRS and 5G get more widely deployed, the Wi-Fi networks may end up performing incredibly well and thus providers may not want to take them down since Wi-Fi is so popular globally. If the delay-sensitive or bandwidth hogging video apps move to CBRS, then browsing over Wi-Fi should be extremely satisfying.

9. CBRS remains the elusive unicorn but may turn out to be a Narwal: different, unique and highly specialized. Also, breaking from the analogy—not a stand-alone technology. More of a supplemental spectrum addition to LTE initially and 5G eventually. Device support will be key here and that is very uncertain at this point. Verizon says there will be CBRS smartphones but as of this writing, the latest iPhones Phone models, the Xs, Xs Max and Xr support 5GHz unlicensed (T-Mobile and Verizon), First Net Band 14, T-Mobile’s 600MHz spectrum, but no CBRS. Until the FCC decides on its PAL strategy, many operators are waiting on the sidelines. As one MNO said, “if they (the FCC) decide on a three-year license we may have to take a pass. It takes three years to get a network deployed and making money. We do all of this and risk losing the license?”

10. NFV/Virtualization/Cloudification gets real in terms of a reality check. The benefits of NFV and cloudification are getting reset, gone are the promises of a 30% reduction in cost and replaced by suggestions of agility and time to market. The shift from capex (purpose-built platforms) to opex (COTS hardware and software licenses) has not necessarily reduced costs and pricing models are immature.

Orchestration software is not yet telco-grade, and early cloudification initiatives by Affirmed and Mavenir to run on public clouds, such as AWS and Azure, are first steps taken by MVNOs and Tier 3 operators that likely will see the public clouds offer more stringent performance guarantees.

Overall, the software-driven market is having something of a reset, as the operators push back looking for more mature orchestration platforms, as well as more tightly integrated solutions. System Integration concerns are slowing the multi-vendor approach to open networks, and the traditional telco suppliers Ericsson, Nokia and (not in the US) Huawei benefit from providing an end-to-end solution with open interfaces to plug in third-party applications such as vEPC, vIMS. There are also far too many different standards bodies/industry bodies trying to push their agendas. We will see by MWC Barcelona if this area starts to shake out.

Last year, I concluded my report by saying that the MNOs were lacking in participation; this is definitely not the case this year. Weaved into the 5G story were some helpful bits about 4G expansion, particularly Sprint’s MMIMO deployments in 2.5GHz. However, the overwhelming focus on 5G made it difficult to parse out what else of significance is going on in the industry. MEC and IoT both suffer from a lack of clear definitions (as does 5G) and the focus on use-cases instead of business cases hides the fact that these technologies are delivering real solutions and benefits today. Five months till Barcelona; we’ll see what happens next!