Sandvine’s report analyzes the applications that are driving the increase in data consumption

The continuing pandemic has forced millions of organizations and individuals around the world to adopt technological methods of living, working, and learning. The quick growth in demand for technology has put pressure on fixed and mobile networks, compelling operators to make swift adjustments to utilize existing capacity more efficiently. Digital and digitally connected products in business portfolios have accelerated by up to seven years, resulting in a growth in video streaming, enterprise conferencing, gaming, social media, and messaging.

This shift in Internet traffic patterns has not been without collateral damage. The popularity of TikTok and other short-form video platforms has resulted in a 30% drop in YouTube's traffic year-over-year. Facebook, on the other hand, has experienced a large decline in traffic, representing double-digit declines across the board as people return to pre-pandemic consumption patterns. Younger individuals have migrated to TikTok for short-form videos, causing a 61% decline in social networking. This tendency is anticipated to continue.

To understand the complexities of internet traffic beyond the surface level, Sandvine report has released its yearly report in which it discusses and delves into the applications that are driving the exponential growth in data consumption.

About the Sandvine Report

The Sandvine Global Internet Phenomena Report is a highly recognized annual report that provides an in-depth look into internet traffic patterns and the applications that drive them. The study is widely regarded as the industry standard on this subject and has become an indispensable tool for comprehending the ever-changing landscape of internet usage.

This year's report provides a comprehensive examination of the most recent trends and advances in internet traffic and underlines the difficulties service providers face as a result of this traffic surge.

Summary of the Sandvine Report Findings

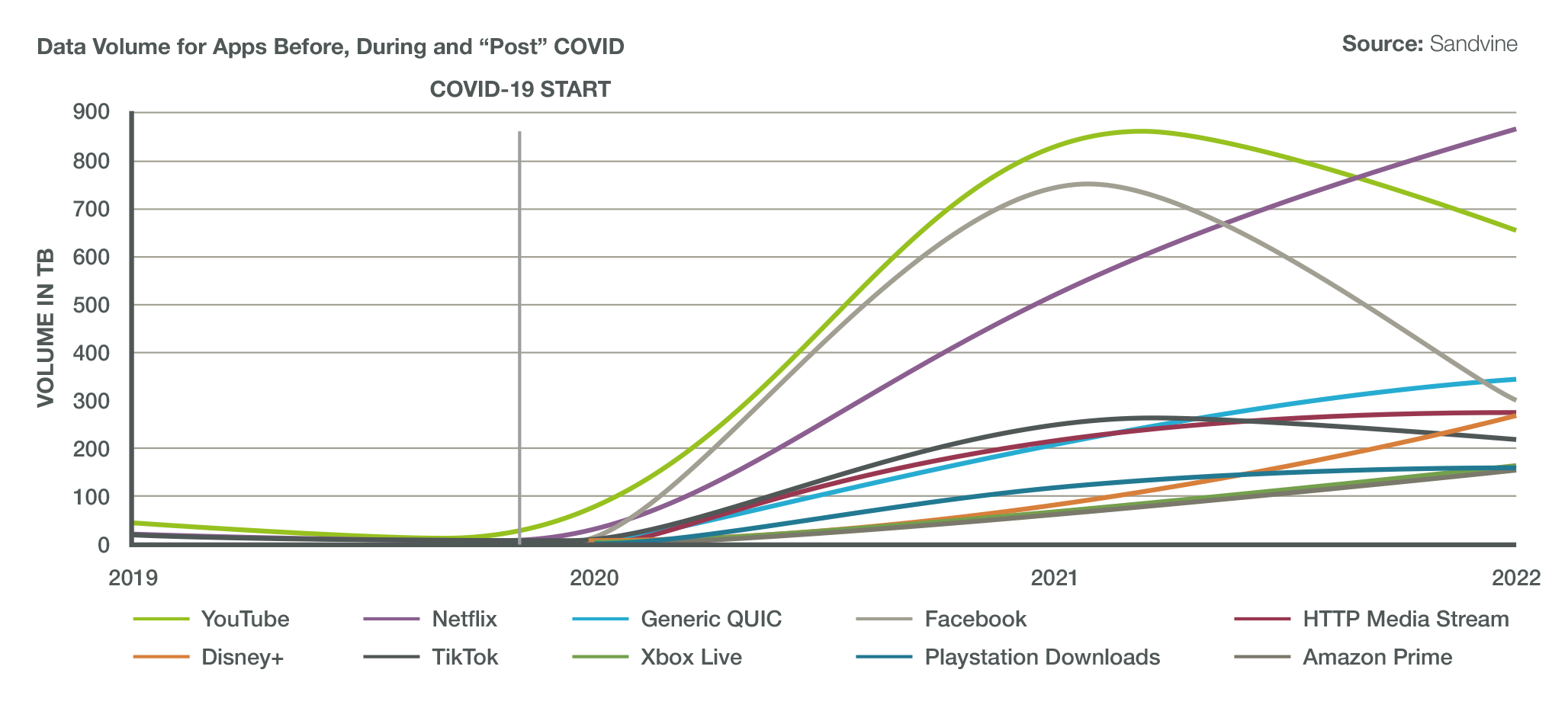

The quick growth in demand for technology has put pressure on fixed and mobile networks, compelling operators to make swift adjustments to utilize existing capacity more efficiently. This has accelerated capital spending for optical fiber, 5G, and virtual private networks, and other technologies to address the demand for video streaming, workplace conferencing, gaming, social media, and messaging have increased. The following charts compare Q1 traffic for key applications from 2019 to 2022, highlighting the rise in traffic during the period of Covid lockdowns and social distancing.

The rapid spikes in 2020 and the gradual increases in 2021 had a substantial effect on internet traffic for fixed broadband, mobile, and WiFi networks. According to global operators, fixed broadband usage increased by 20 to 50%, and mobile broadband usage grew by 15% to 35%. In 2020 and 2021, people and organizations with dependable ISP services used fixed broadband for essential applications and services, while those without dependable fixed internet used mobile.

The pandemic has had a long-lasting effect on internet traffic patterns and how people utilize technology. We anticipate this shift in internet traffic patterns and a greater reliance on technology to continue.

Figure 1: Data Volume Pre and Post Pandemic (The Sandvine Report 2023)

The traffic on YouTube decreased by 30% compared to the same period last year. This is partially due to the comeback of in-person events, as well as the growing popularity of TikTok and other short-form videos. In an effort to offset these losses, Google has established YouTube Shorts, which by the end of the third quarter of 2022 had amassed 5 trillion total views. Google intends to monetize this momentum with a 45% revenue split for producers, encouraging those with at least 1000 subscribers and 10 million Shorts views over 3 months. Google's battle with TikTok and other services, such as Pinterest and Instagram Reels, will intensify as a result.

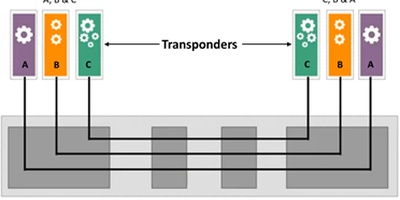

A considerable amount of the YouTube traffic is encrypted Quick UDP Internet Connections (QUIC), which was the third-largest contributor to volume in the first half of 2022, 5.41%, a 41% increase from 2021. Numerous other platforms use QUIC for more stable, quick, and secure video content-based applications, making it a popular option among platforms for delivering video content.

Facebook's visitor volume has decreased significantly. The social media behemoth has fallen from second to third place on the overall brands chart, posting double-digit declines across the board. This may be because people are returning to school and work, resulting in a decreased reliance on group video conversations and messaging.

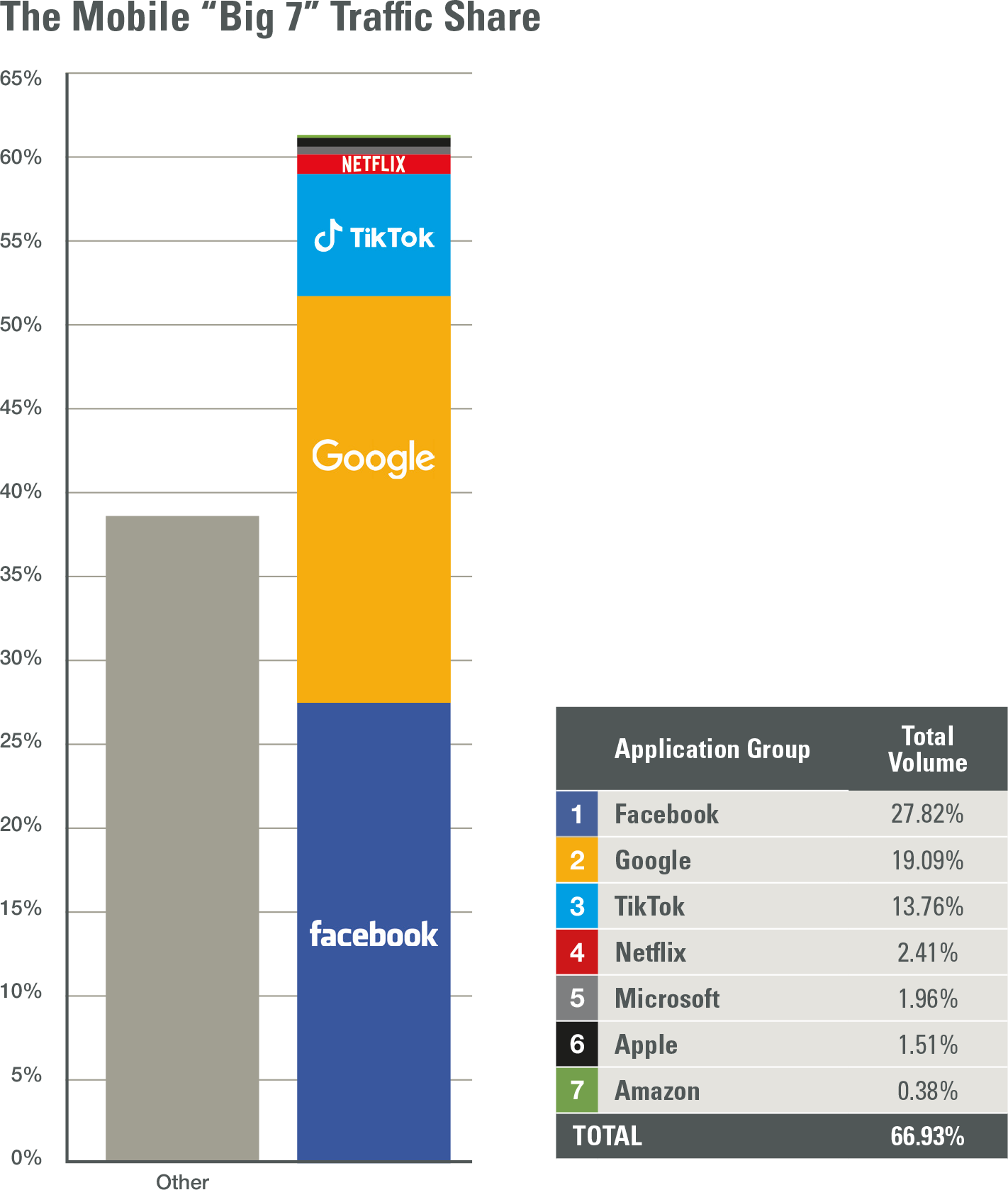

The survey shows a 61% decline in social networking, with younger people gravitating to TikTok for short-form videos. The popularity of TikTok is primarily attributable to its customized For You feed of clips based on the user's usage and habits. Several Instagram content creators are experimenting with Reels to see if video will restore the platform's popularity, although some digital marketing studies attribute the decline in reach to advertisements and influencer saturation.

Mark Zuckerberg, CEO of Facebook, is focusing on the Metaverse and social virtual reality and is investing $100 billion in RealityLabs to create 3D virtual places, despite Meta's revenue decline in the first half of 2022 and market dynamics such as inflation driving down ad revenues on platforms such as Facebook and Instagram. Analysts question if Zuckerberg’s plan will pay off quickly enough.

Facebook, with 2.96 billion monthly active members as of the third quarter of 2022, remains the preeminent social network worldwide despite the obstacles: however, the company is incorporating more video into its platforms in an effort to increase interest and participation. Its relationship with Ray-Ban for smart glasses may lead to an increase in the number of movies and images integrated into Facebook View.

Figure 2: Traffic Share (Source: The Sandvine Report 2023)

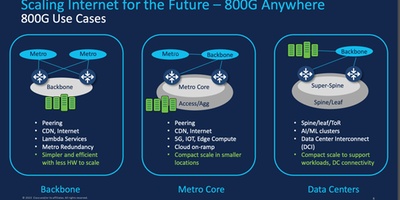

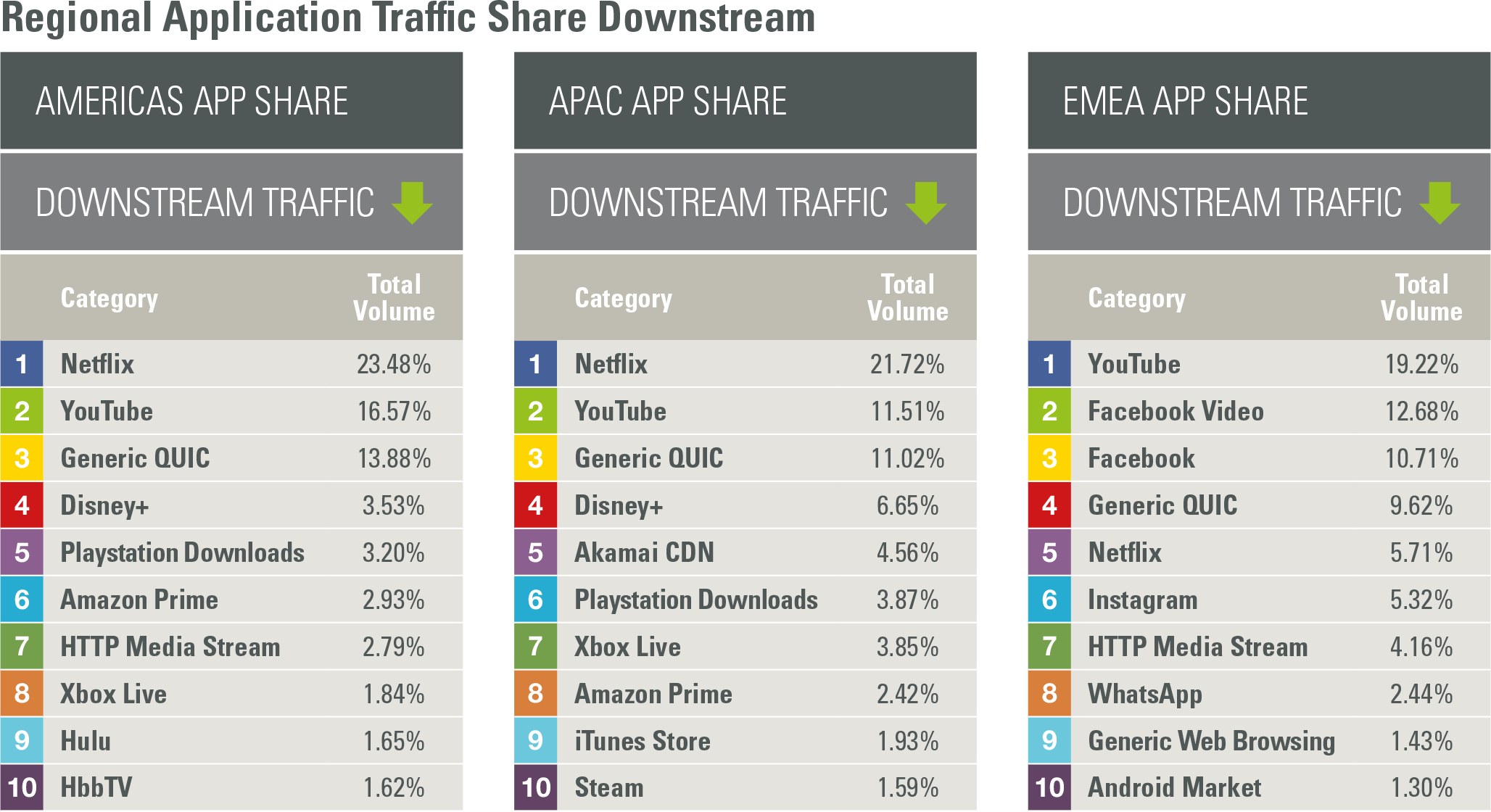

Increased availability of high-definition (HD) and ultra-high-definition (UHD) material on streaming services, such as Netflix, has a significant impact on networks. According to Cisco’s Annual Internet Report, streaming a two- or three-hour HD television program can create as much internet traffic as a whole household in a single day. UHD content has even higher bit rates, and it is estimated that by 2023, 66% of flat-panel televisions will be UHD, causing the average global fixed broadband speed to climb from 46 Mbps in 2022 to 110 Mbps in 2023.

With the growth of 5G, mobile speeds are also improving, with an average speed of 575 Mbps, which is 13 times faster than the typical mobile connection. This improvement in speed, coupled with the rising popularity of AR/VR and UHD video, is anticipated to result in a substantial rise in network demand and traffic.

The complexity of new apps compounds this growth in demand and traffic for network operators. Multiple web sites, feeds, and functions have been incorporated into a single app, making applications more complex. With the proliferation of messaging and chat apps, operators must be able to determine which sections of the app’s content are sensitive to latency and which are not. They must be able to prioritize different types of content based on users’ requirements, such as preferring gaming quality over voice and video or video packets for a Zoom call.

On the app side, Weixin/WeChat, an app in China, offers 3.5 million app-driven mini programs that create all-encompassing experiences for consumers and enterprises. These mini programs include services such as instant messaging and phone calls, location sharing, search, QR codes, eWallet, money transfers, and news feeds. Facebook and its subsidiary WhatsApp are also rapidly growing its services to consumers and businesses via their respective platforms, with Facebook Messenger sending 100 billion messages every day alone. As consumers get more familiar with messaging and chat, businesses will seek more frictionless digital engagements, leading to these apps becoming sophisticated ecosystems that allow users to communicate across various applications and platforms from one place.

Figure 3: Traffic Share Downstream (Source: The Sandvine Report 2023)

Paying Their Share

The emergence of HD and UHD content on streaming platforms has triggered a turning point for service providers. In light of the growing demand for higher-quality video content and the emergence of 5G networks, service providers face an unsustainable traffic growth dilemma. Therefore, service providers must find a means to monetize this traffic growth and convince regulators to contemplate intervention.

As 5G networks proliferate, mobile speeds are improving, with an average of 575 Mbps, 13 times faster than the typical mobile connection. This improvement in speed, coupled with the rising popularity of AR/VR and UHD video, is anticipated to result in a substantial rise in network demand and traffic. As a result, service providers are facing a tremendous challenge in terms of infrastructure and pricing.

Currently, service providers are mostly selling their services through subscriptions and data plans. However, with the increase in demand for higher quality video content and the emergence of 5G networks, these monetization strategies will no longer be sustainable in the long term. Service providers will have to discover new ways to monetize this traffic growth to retain their profitability.

A viable approach would be for cloud providers to pay for the infrastructure or contribute in some way. Cloud providers, such as Netflix and Amazon, are the key drivers of this traffic growth, but they do not yet contribute to the costs of maintaining and improving the networks. This causes a financial strain on service providers, and it is not a sustainable business model for the long term.

Regulators can play a significant role in ensuring that all stakeholders are paying their fair share of the costs associated with maintaining and upgrading the networks by enacting regulations requiring cloud service companies to pay for infrastructure or otherwise contribute their fair part. This could be accomplished through a variety of techniques: levies, taxes, and other fees. The precise system would depend on the area or region in which the service providers operate, but the objective would be to ensure that cloud service providers contribute to the costs of maintaining and upgrading networks.

Another alternative is implementing legislation that would require cloud providers to contribute a portion of their earnings to a fund that would be used to upgrade and maintain the networks. This would be comparable to the way that utilities are controlled, where corporations are compelled to contribute to a fund that is used to build and maintain the infrastructure.

Regulators should also focus on drafting policies to promote fair competition among all stakeholders. This might be done by adopting regulatory frameworks that would prevent cloud providers from dominating the market. This would allow service providers to compete on a more level playing field.

Cloud providers such as Netflix and Amazon might pay for the infrastructure or pay their fair part as a potential solution. According to the Sandvine analysis, these providers are the biggest contributors to traffic increase; however they currently do not contribute to infrastructure expenditures. This causes a financial strain for service providers and is not a long-term viable business model.

As the demand for internet traffic continues to expand, service providers must understand traffic patterns and adjust their existing business models to maintain their profitability. Cloud providers have a role in supporting service providers while fostering a level playing field for all parties involved.

For more information, contact Ray Mota at rmota@acgcc.com.