A leader in PON and other broadband technologies, Nokia is positioning itself as a key player, capitalizing on the massive broadband for everyone initiatives in many countries.

Nokia’s fixed networks business is on an overall growth trajectory, despite short-term headwinds in some markets, caused by consuming existing inventory, tight labor markets, and cost of capital. North America is leading with XGS-PON deployments, Europe is primarily deploying GPON but is expected to transition to XGS-PON in the near future. In APAC, new Chinese competitors are pressuring prices. Overall demand continues to be strong, driven by the continued growth of broadband traffic (20% to 30% CAGR) and the massive influx of capital.

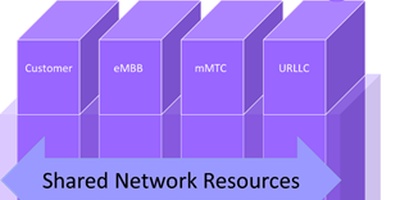

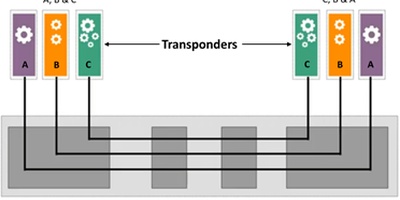

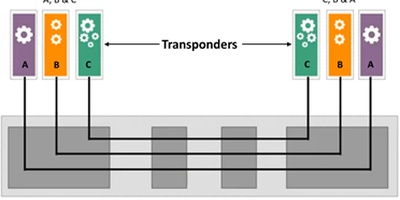

Nokia is a market leader in PON, the technology powering the majority of today’s broadband deployments. XGS-PON is at the beginning of mass deployments (Nokia has over 150 deployments to date in 2023), with 25GS PON coming right behind (and backward compatible) with deployments by nine operators. Not far ahead is 50GS PON and further out 100GS PON and 200GS PON with coherent optics. Given the fast-evolving market, Nokia is committed to supporting the co-existence of 3 PON technologies on the same fiber. This enables operators to run 3 generations of PON on the same fiber at the same time. For example, an operator could have deployed GPON, 10G and 25G, then migrate to 10G, 25G and 50G when GPON no longer meets their needs.

Nokia is also committed to other broadband technologies. It is seeing significant growth in FWA and expects 20% of FWA deployments to use newer mmWave technologies, which are delivering speeds such as 2Gb/s downloads at 11Km with line of sight.

Nokia is supplementing these technologies by investing in automation, open APIs, digital ops, slicing and cloud-native technologies and by introducing solutions that improve the end customer’s experience, such as Corteca for WiFi management.

Governments’ efforts to close the digital divide in many countries have spurred investments in broadband on a scale and scope never seen before. This has attracted many types of players to the market. In addition to the Tier 1 operators and MSOs that Nokia has traditionally served, Tier 3 and 4 operators, utilities, neutral hosts, private equity firms are newer market segments with widely variable capabilities and needs. Nokia is striving to effectively serve these market segments through product innovation (for example, Corteca, network in a box) but is also developing go to market strategies and support capabilities that are aligned with the needs of these newer market segments.

An essential requirement for serving customers who use Broadband Equity, Access and Deployment (BEAD) funding in the US is the “made in the US” clause. Nokia worked closely with NTIA and other government entities and was the first to comply with this requirement, as it announced on August 3, 2023, that the manufacturing of fiber-optic broadband network electronics products and optical modules for use in the BEAD program will move to the US through its partnership with Sanmina.

For more information, contact Liliane Offredo-Zreik.