BUSINESS

The search continues for Blue Money

The industry growth of 1% is unimpressive, given the investments operators need to make. Operators (and vendors) are looking for growth (blue money from the blue ocean) or at least focused growth areas. Operators want to know Where are the killer apps? A year ago it seemed to be agricultural IoT, given the number of demos. This year, industrial IoT and Fixed Wireless Access (FWA) were pushed.

Meanwhile, vendors are looking for growth areas.

- AI/ML and network automation continue to grow strongly. Every hardware (and virtualized network function) vendor has its own automation software as well as working with other vendors’ software. Network function vendors continue to dominate in the domain controllers, while independent software vendors serve the majority of the cross-domain orchestration use cases.

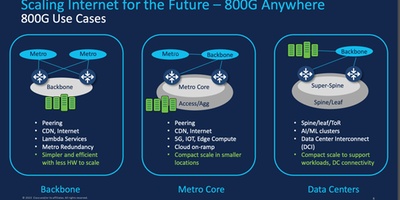

- Access network transformation is starting, driven in the near term by the growth from work anywhere recently, but also by 5G backhaul, government subsidies and private equity for fiber deployments, HFC growth (especially in the upstream direction), fixed wireless access, and satellite access. The over $100B investment will fuel major growth in the next few years, while industrial IoT and then the industrial and consumer metaverse will continue. This is already having a major effect on hardware and software vendors in the access market, as well as upstream metro. Operators are seeking high-bandwidth, low power-consumption, automated solutions that can adapt as the access needs and loads change.

Hyperscalers are aggressively entering the market

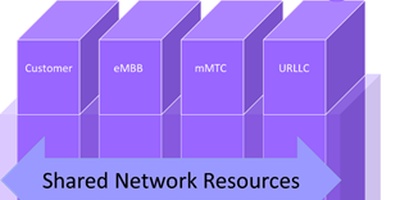

Every hyperscaler has cut major deals with equipment vendors and operators to provide the network compute and storage needs of virtual network functions (whether virtualized or containerized). Some large-scale commercial deployments are in place, but private 5G is the sweet spot.

TECHNOLOGY

O-RAN deployment a disappointment but still moving along

We have been talking about how O-RAN deployment is slow for over a year, and it continues its slow growth. Virtualized RAN is progressing faster. Several deals around multivendor solutions involving the nonreal-time O-RAN RIC were announced, but commercial deployments are not in evidence yet.

5G is real, even 5G SA

5G Standalone is being deployed at a good pace in most markets, providing faster speeds but not much else yet.

5G Advanced (aka 5.5G) will bring many of the benefits we originally expected from 5G

Discussions of 5G Advanced and 5.5G technology (which also includes fixed access) were evident, especially from Huawei, which has a major program to promote it. The arguments and use cases sounded very familiar though.

Automation is everywhere

Every vendor has software automation to go with its hardware, with its virtualized network functions or OSS and BSS systems. AI/ML is making it into RAN at the chip level, mostly for power management. AI/ML for proactive maintenance and security continues to grow strongly but is being applied across the board.

Energy savings is ubiquitous

Sustainability to most vendors means power savings with the new electronics of 5G and higher-speed PON systems taking three to five times as much power without special control functions being implemented. This can be a large part of an operator’s budget and is increasingly important.

Private wireless is more than private 5G

Although private 5G was the watchword, most private wireless systems use 4G technology. But private 5G still represents a major opportunity, especially with 5.5G with its expected centimeter-level positioning determination capabilities and the higher speeds. With multivendor O-RAN and hyperscaler-hosted core networks, it should be a major opportunity for vendors. Will the operators benefit? Somewhat, but without a major push, they will not build a strong managed services business although the opportunity for private 5G + SD-WAN + SD-LAN looks interesting.

Impressive Booth Items

Nokia’s booth a stunner

Nokiadid a major rebranding with a new logo, bold colors and a lot of marketing hoopla around its rationalized product set. Nokia’s decision to try to grab 6G leadership was a bit of a misfire.

Huawei goes big

The Huawei booth was impressive, as was its set of demos around 5.5G, fiber to the room (with a very handy fiber ribbon for walls), and Autonomous Driving Networks (Huawei’s vision and product line that realized the TM Forum’s Autonomous Networks standards). Its off-site analyst summit on 5G covered the vast breadth of the Huawei products, both hardware and software, focusing on 5.5G.

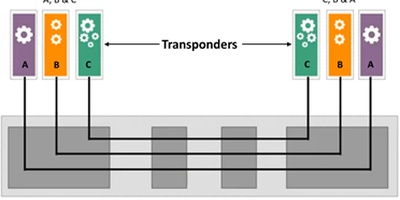

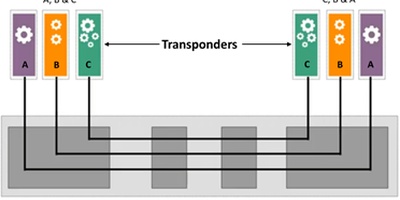

HPE trying to break the domain control model with its Greenlake offer for telco cloud

Tucked into a corner, HPE, as part of its Greenlake SaaS offering set, demonstrated an impressive different architecture than normal for an overall network control plane. Bypassing the CDO/DC architecture, the HPE Telco Cloud offering expands the virtualized infrastructure domain control to also include the creation and maintenance of the telco network control plane. Using HPE Service Manager and NFV Manager, it not only does the provisioning of the virtualized infrastructure for VNFs and CNFs (as usual), but also provisions the communications fabric among the various virtualized functions, requiring them to be implemented as SRV6 links. It leaves the usual set of domain controllers untouched for doing the rest of their normal jobs but oversees the provisioning and assurance of the network control plane. HPE will hopefully do better at marketing its innovative approach than usual.

Conclusion

It was a large, good conference with impressive demonstrations, many use cases, and good discussions of commercial deployments. Next year should be even better.

Contact Mark Mortensen at mmortensen@acgcc.com.