Are Service Providers Truly Ramping up Deployment of Open Optical Networking?

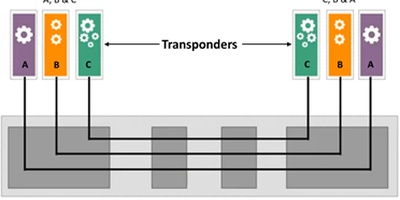

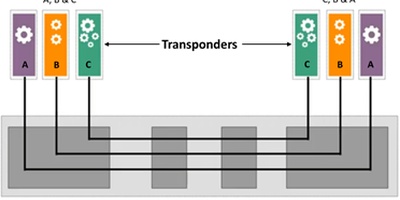

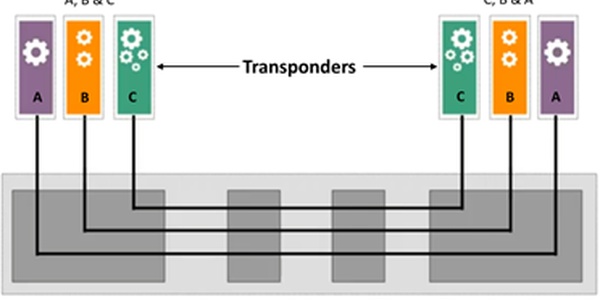

Open optical networking, the optical network design methodology that disaggregates transponders from the underlying optical line systems1, appears to be gaining momentum in the marketplace. To better understand the demand for and the potential impact of open optical networking on the evolution of service providers’ transport networks, ACG Research conducted primary research during Q2 2021 on the value of open optical networking, the approach service providers are likely to take in their open optical networking investments and deployments, and their preferences about how they will work on this network transition over the coming years. We surveyed 52 network engineering and planning practitioners, globally, and engaged in detailed interviews with an additional four service provider managers and executives. For more information about the survey results, see the survey whitepaper Directions in Open Optical Networking for Service Providers’ Transport Networks.

This first of a two-part blog is an analysis of the reasons for and evidence of the demand for open optical networking based on insights gained from these surveys and interviews. In Part 2 we will take a look at how the popularity of open optical networking does not extend to all service providers; it varies with the service provider type. The open optical networking study also addresses the sources of network growth and the automation and management of open optical networks, but those topics that are not taken up in this blog.

Service providers seem to be prepared to shift a significant portion of their upcoming optical network deployments to open optical networking. To judge the reality of this impending ramp-up of open optical networking deployment, the surveys and interviews focused on two questions: whether service providers have clear reasons to embark on this network transformation and whether they are ready to make the change to the new optical design paradigm.

The survey revealed that service providers do embrace specific reasons for deploying open optical networking. Further, their readiness to deploy is reflected in:

- The portion of service providers that have already deployed some optical systems that support alien wavelengths2;

- Service providers’ expectations of the timing of open optical networking deployment;

- A robust growth of optical network demand.

Reasons for Transforming the Network to an Open Model

Faster Innovation

The survey respondents agreed that the greatest benefit they would gain from open optical networking is its support of faster innovation cycles, which allows quicker adoption of technological advances as they occur as compared to using closed systems. This concept of rapid innovation in optical networking is not merely hypothetical. The industry is currently experiencing the emergence of two advances that are greatly facilitated by open optical networking, 400G coherent optical pluggable modules and 800G coherent transponder technology.

400ZR and 400ZR+ coherent optical pluggable modules promise to provide significant (if not radical) savings for the connections between routers, switches, and multiplexers. Because it is unlikely that the 400ZR and 400ZR+ coherent optical pluggable modules will be sourced from the optical line system vendor, savings provided by 400ZR and 400ZR+ are largely dependent on the use of open optical networking for these connections. Thus, widespread deployment of these coherent optical pluggable modules should drive deployment of open optical networking.

400ZR Coherent Optical Pluggable Modules

Service providers and optical networking vendors, through the Optical Internetworking Forum, developed the 400ZR coherent optical interface to be used on 400 Gb/s transponders with the same form factor as the emerging 400G high-density QSFP-DD and OSFP pluggable modules used in the latest generation of routers and switches. A critical feature of 400ZR is its support for multivendor interoperability because the interconnection of routers and switches from competing vendors is common, and the switch or router vendor will often be the source of the pluggable modules for its product.

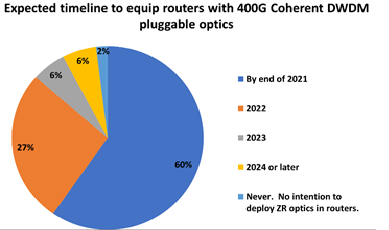

Because of the aforementioned savings provided by coherent optical pluggable modules, this solution has generated intense interest among service providers. Accordingly, the online survey picked up this interest among the respondents: 59% of the respondents reported that they have either deployed or will have deployed 400ZR by the end of 2021. The percentage of respondents that anticipate the initial deployment of 400ZR by the end of 2022 rose to 87%.

Figure 1. Anticipated Timeframe for Deployment of 400ZR

400ZR+ Coherent Optical Pluggable Modules

Optical system and component vendors have also designed equivalently sized 400G coherent optical modules, often called 400ZR+, that overcome some of the limitations of 400ZR modules. The 400ZR+ modules have a significantly greater reach than 400ZR, and they can be used across ROADM connections (whereas 400ZR cannot). Some optical vendors and service providers have used these less-restrictive modules in trials or proof of concept settings3. Although some of these trials are based on the vendor’s proprietary technology to extend the module’s reach without increasing its power, some Multi-Source Agreement (MSA) groups, such as the Open ZR+ MSA group, are developing specifications to overcome the 400ZR limitations. In this blog, any 400G coherent optical modules that overcome the 400ZR limitations are referred to as 400ZR+.

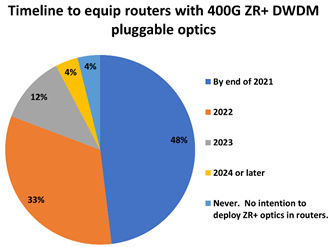

The 400ZR+ coherent optical pluggable module is proving to be nearly as popular as the 400ZR: 48% of respondents anticipate deploying 400ZR+ by the end of 2021, and the percentage that expect to begin deployment by the end of 2022 is 81%. Some vendors have a greater interest in 400ZR+ than 400ZR because the 400ZR limitations restrict (in some cases, prevent) its use in their networks.

Figure 2. Anticipated Timeframe for Deployment of 400ZR+

800G Coherent Optical Technology

The demand for optical network systems that offer 800 Gb/s coherent optical channels is another use case for open optical networking. The commercial availability of this technology is relatively recent; there are still only a limited number of vendors offering 800G capable systems. However, because the primary 800G technology is based in the transponders (rather than in the optical line systems), an open optical line system would enable a service provider to select a transponder vendor that offered 800G even if it was a different vendor than the service provider’s line system vendor.

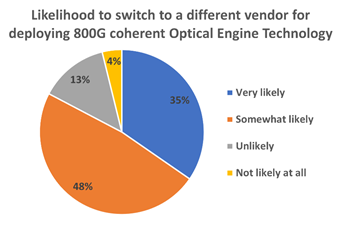

The popularity of this use case is reflected in the 83% of the online respondents that indicate that they would deploy 800G coherent optical engine technology from a nonincumbent vendor. Service providers also anticipate needing this 800G capability soon; 79% of the respondents indicate their companies will deploy 800G coherent technology by the end of 2022.

Figure 3. Likelihood of Switching to a Different Vendor for Deploying 800G Coherent Technology

Evidence of an Imminent Transition to Open Optical Networking

Current Open Optical Network Capabilities

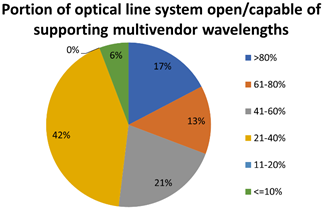

The initial form of open optical networking, support of alien wavelengths, has already been deployed by a significant portion of the service providers. Just over half of the online survey’s respondents indicated that between 40% and (up to) 100% their networks currently provide this version of open optical networking.

This large portion of the service providers that have begun to deploy optical network systems that support alien wavelengths suggests that the open optical design methodology has already achieved broad acceptance, suggesting that further open optical network deployments are likely.

Figure 4. Portion of Respondents Indicating Current Degree of Penetration of Their Networks with Alien Wavelength Capability

Service Providers' Expectations

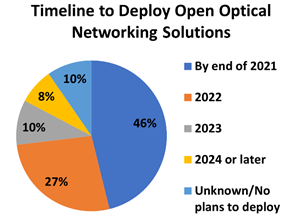

In addition, service providers expressed confidence in open optical networking as they estimated when their first open optical network systems would be deployed. Seventy-three percent of the respondents expect to deploy open optical networking solutions by the end of 2022. These results suggest that not only will open optical networking be deployed on a widespread basis but that most of its deployment will occur within two years.

Figure 5. Timeline to Deploy Open Optical Networking Solutions

It should be noted that these service provider respondents do not consider the support of alien wavelengths as being full open optical networking. In response to a separate survey question addressing the support of alien wavelengths in their optical networks, 94% of the respondents indicated at least some level of alien wavelength support at the present time. On the other hand, as indicated in Figure 2, only 46% of them anticipate deploying open optical networking by the end of 2021.

Network Growth Rate

A factor that facilitates deployment of open optical networking is rapid network growth. Such growth can enable the introduction of open optical networking without requiring the replacement of existing infrastructure.

Online survey respondents and the interview respondents indicated that their traffic growth is increasing optical network demand by 40% to 70% annually. If network growth were modest, few new optical line systems would be deployed as service providers would be motivated to fill up existing lines with wavelengths before deploying the next optical line. Even when the next optical line system is deployed, the benefit of the new system is realized only as fast as new wavelengths on it are filled, postponing the benefit. Traffic could be moved off the old optical line system(s) to the new in order to retrofit the original systems, but such transitions are slow, risk service interruptions, and are expensive.

However, since traffic growth is great, the service provider can deploy and fill new open optical line systems rapidly, quickly gaining the benefits of open optical networking. Over time, network churn will decrease the fill of the old optical systems, ultimately leading to a less costly retrofit.

Validity of Demand for Open Optical Network Deployment

This Part 1 blog has examined the popularity of open optical networking. Each of these reasons for the deployment of open optical networking by service providers is confirmed by the findings of the open optical networking survey (Directions in Open Optical Networking for Service Providers’ Transport Networks):

- Service providers are motivated to deploy open optical networking to achieve faster innovation.

- The intense interest service providers have in the deployment of 400ZR and 400ZR+ coherent optical pluggable modules implies a similar interest in open optical networking.

- The demand for optical network systems that offer 800 Gb/s coherent optical channels, even if sourced from a nonincumbent vendor, also implies interest in open optical networking.

- A significant portion of the service providers already support of alien wavelengths in their optical networks.

- Most of these service providers anticipate the deployment of open optical networking in their networks in the next couple of years.

- The service providers’ optical networks are growing at a high rate which can enable the introduction of open optical networking without requiring the replacement of existing infrastructure.

In the next installment of this blog, I will take a look at the reasons that this popularity of open optical networking does not necessarily extend to all service providers; it varies with the service provider type.

Click to read more and download the survey: https://www.infinera.com/blog/three-trends-accelerating-the-future-of-optical-transport-networks/tag/open-optical-networking/

Click for more information about Rick Talbot. Contact him at rtalbot@acgcc.com.

_____________________________________________________

1. In the context of this study, an optical line system consists of the fiber pair segments and optical equipment (combiner/splitters, optical amplifiers and optical add/drop multiplexers) that support the transmission of wavelengths between transponders. Each transponder’s optical transmitter presents a single wavelength optical signal to an optical multiplexer that places multiple such optical signals on the transmit fiber. Each optical signal is transmitted from its origination site to its termination site via fiber connections to amplifier(s) that boost the signal and optical add/drop multiplexer(s) that redirect the optical signal (at its particular wavelength) to the fiber segment that connects to the destination. There the signal is extracted from the fiber segment with an optical demultiplexer and connected to a transponder’s receiver.

2. An alien wavelength is an optical signal between transponders sourced from a different vendor than that of the optical line system.

3. For example, as announced in the press release NeoPhotonics Announces Demonstration of 400 Gbps Transmission Over 800km in a 75GHz-spaced DWDM System by Its QSFP-DD Pluggable Coherent Module