Open Optical Networking: Popular but not Universally so

As I explained in my Part 1 blog in January, Are Service Providers Truly Ramping up Deployment of Open Optical Networking?, during Q2 2021, ACG Research conducted primary research on the value of open optical networking to better understand the demand for and the potential impact of open optical networking on the evolution of service providers’ transport networks (Three Trends Accelerating the Future of Optical Transport Networks). The study found that service providers appear to be prepared to shift a sizable portion of their upcoming optical network deployments to open optical networking. This readiness is reflected in:

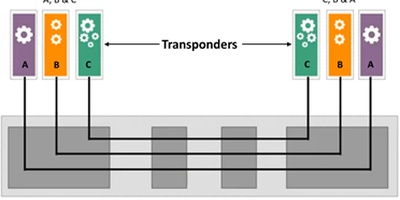

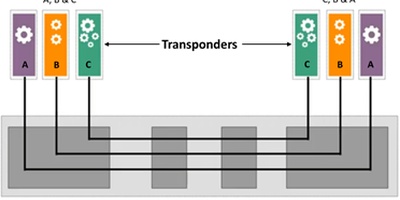

- The number of service providers that have already deployed some optical systems that support alien wavelengths[1];

- Service providers’ expectations of further open optical networking deployments;

- A robust growth of optical network demand;

- New transponder technologies that are benefitted by open optical networking.

However, popularity of open optical networking does not necessarily extend to all service providers; it varies with the service provider type. This Part 2 blog examines the reasons that this popularity of open optical networking does not necessarily extend to all service providers; it varies with the service provider size and type.

Service Provider Sensitivity to Complexity

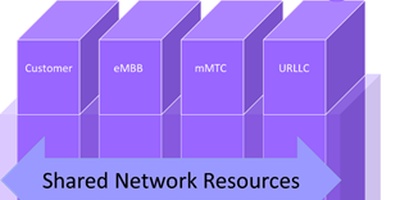

Complexity is the enemy of all service providers. Open optical networking, by its nature, introduces complexity with the optical signal being processed by the equipment of multiple vendors, each with its own design rules and management system. The process of choosing the orchestration management/automation controller is similarly complex. Specifically, though there is general agreement on the criticality of SDN for the planning, design, and management of open optical networks, the service provider is left with a myriad of choices for the architecture of its SDN solutions:

- Whether to use a single multidomain SDN controller to directly access the network elements.

- In the case of a hierarchical SDN architecture, where the multilayer orchestration takes place.

- The sourcing of the various controllers/orchestrators.

- The sourcing of the software for the parent controllers and orchestrators, particularly for use in white-box solutions.

- Selection of the entity that programs and integrates this hierarchical SDN control network.

Service providers’ sensitivity to this complexity depends on service providers’ size and type. Data center operators are relatively familiar with Domain Control and Orchestration (DCO) while wholesale bandwidth providers often have very little experience with network control systems other than the element management systems provided by their transport vendors. From a size perspective, a large incumbent local exchange carrier or interexchange carrier operates multiple network management systems and often attempts to converge them, developing their own DCO system. These operators are familiar with such complexity, whereas small independent (often rural) local exchange carriers do not have that experience. Hyperscalers will be the least sensitive to the complexity of open optical networking since they have significant size and experience in multivendors’ control systems.

Ownership of Fiber Facilities

Some providers obtain much of their fiber from other facilities-based companies, so full utilization of each fiber pair is critical. These providers need to keep the optical engine technology on their existing optical lines continuously up to date to take advantage of the greatest bandwidth efficiency available. This need for constant equipment updates makes open optical networking essential. Conversely, facilities-based service providers are likely to turn up new optical lines to implement new optical engine technology; they are less likely to see a need for open optical networking.

Network Growth Rate

As noted in the previous blog, most service providers are experiencing significant growth. When this is the case, the service provider can deploy and fill new open optical line systems rapidly, quickly gaining the benefits of open optical networking. Over time, network churn will decrease the fill of the old optical systems, ultimately leading to a less costly retrofit.

However, for those service providers whose network growth is modest, few new optical line systems are deployed; they are motivated to fill up existing lines with wavelengths before deploying the next optical line. Even when the next optical line system is deployed, the benefit of the new system is realized only as fast as new wavelengths on it are filled, postponing the benefit. Traffic could be moved off the old optical line system(s) to the new in order to retrofit the original systems, but such transitions are slow, risk service interruptions, and are expensive.

Service Provider Type: Over the Top (OTT) & Cloud Providers versus Communications Service Providers (CSPs)

OTT/cloud providers are relatively uniform in their desire for open optical networking. They generally do not invest in their own fiber infrastructure, and, as previously noted, providers that obtain much of their fiber from other facilities-based companies need constant equipment updates that make open optical networking essential. Further, OTT/cloud providers’ rapid growth pushes them to employ the newest technologies on both new and existing optical systems. They are the poster child for open optical networking. CSPs, on the other hand, are generally facilities-based, so they turn up new optical lines to satisfy network growth, thus are less likely to need the rapid equipment upgrades facilitated by open optical networking.

A difference in open optical networking uptake by OTT/cloud providers versus CSPs is also driven by their demand for 400ZR versus 400ZR+ coherent optical pluggable modules.

The Optical Internetworking Forum (OIF) 400ZR coherent optical interface specification allows 400ZR module interoperability on an end-to-end basis, but 400ZR has three limitations:

- Its reach is limited to 120 km;

- Its wavelengths cannot traverse ROADMs;

- It is designed explicitly for 100GbE and 400GbE connections.

Even as the 400ZR interface specification was being developed, network systems vendors and component manufacturers were developing 400G coherent optical modules with QSFP-DD and OSFP form factors that didn’t have the reach, ROADM and service restrictions of 400ZR. The first version of these modules, often named 400ZR+, does not support interoperability on an end-to-end basis, so it must be “book-ended” (both ends sourced from the same vendor). However, the OpenZR+ MSA Group is attempting to drive industry consensus toward a fully open (supporting end-to-end multivendor interoperability) solution that would overcome the performance limitations of the OIF’s 400ZR.

The 400ZR limitations often conflict with the service and network models of the CSPs. These providers generally offer a variety of services, not just IP based services, and many operate ROADM networks in metro areas for flexible interconnection of their traffic across the numerous points of presence within the metro. This offer of non IP services and the use of ROADMs reduce the demand for 400ZR connections by CSPs since 400ZR only supports Ethernet connections (generally used for router interconnection), and 400ZR does not support the use of ROADMs. Further, nontelco CSPs focus on connections between cities rather than short connections within the metro, thereby exceeding the 400ZR reach limitation. Accordingly, CSPs tend to be more interested in 400ZR+ (rather than in 400ZR) because 400ZR+ is not limited by the service, reach, and ROADM limitations of 400ZR.

OTT/cloud providers, on the other hand, provide mostly point-to-point data center connections, interconnecting routers, and switches within the metro. These services and connections are unaffected by the service, reach, and ROADM transiting constraints inherent in 400ZR. The match of 400ZR characteristics with OTT/cloud providers’ service and network features explains the high OTT/cloud providers’ demand for 400ZR. This is not to say that the OTT/cloud providers are not interested in 400ZR+. Hyperscale providers employ many long-haul connections between their giant regional data centers and between those data centers and their Internet peering points. However, the primary demand of OTT/cloud providers is for the totally interoperable 400ZR.

This difference in demand for 400ZR is reflected in the survey results in which 56% of the CSP respondents indicated that they expected to begin equipping routers with 400ZR pluggable modules by the end of 2021, whereas 100% of the OTT/cloud providers indicated that they expected to begin equipping routers with 400ZR by that same time. This result implies that OTT/cloud providers exhibit a greater demand for open optical networking (which is provided by a 400ZR connection) than the CSPs.

Infrastructure Diversity Effect on SDN Deployment

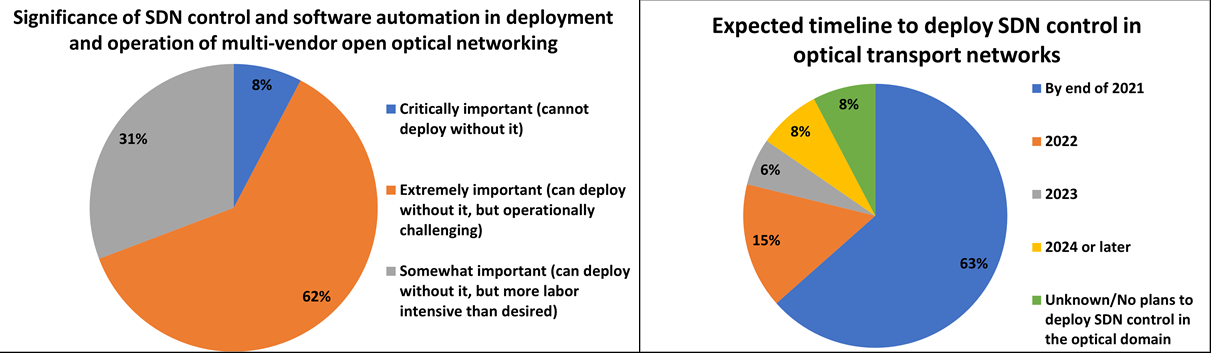

As noted previously, CSPs generally support a wider range of services than OTT/cloud providers. In addition, they support these services with a legacy network made up of numerous technologies. This variety of services and presence of legacy technologies significantly increases the complexity of the deployment and operation of an open optical network, leading to a degree of resistance to widespread open optical networking deployment. Further, CSPs that perceive open optical networking as prohibitively complex may well view SDN automation, which is also likely to be new, as an added complexity. This relatively larger amount of caution toward using open optical networking and its associated SDN automation may be the cause of the 31% of survey respondents, all CSPs, not considering SDN control and automation critical or extremely important. It also may contribute to the 22% of respondents (once again, all CSPs) that do not anticipate deployment of SDN control and automation prior to 2023.

Acknowledging this relatively higher level of caution on the part of CSPs does not dilute the importance of software controls in other circumstances where they may choose to deploy.

Recap of Factors Affecting the Demand for Open Optical Networking

Demand for open optical networking is not universal, with its popularity varying based on the service provider’s type and size. Several factors drive this difference of demand:

- Service Provider Sensitivity to Complexity: Not all service providers have the same sensitivity to network (and network control) complexity. Service providers that are more sensitive are more likely to shy away from the complexity of open optical networking.

- Ownership of Fiber Facilities: Service providers that own their own fiber infrastructure are less motivated to deploy open optical networking to constantly optimize the efficiency of their optical systems. They can simply turn up a new optical system on the next fiber pair.

- Network Growth Rate: Service providers that experience high network growth have less need to retrofit their legacy optical systems to open optical networking; they can focus on deploying open optical networking on the many new optical systems they are turning up. The existence of legacy optical systems is more of an issue for slow-growth service providers; the cost of retrofitting those systems is a significant cost consideration for these service providers, making them less open to the new open optical systems.

- Demand for 400ZR versus 400ZR+ Coherent Optical Pluggable Modules: Service providers that can take full advantage of the efficiencies of 400ZR coherent optical pluggable modules (generally the OTT/cloud providers) experience more demand for open optical networking than service providers (generally CSPs) for whom the 400ZR+ is a much better fit.

- Infrastructure Diversity Effect on SDN Deployment: Service providers whose infrastructures and services are diverse (generally CSPs) find SDN deployment more complex than those with homogeneous infrastructures and services (the OTT/cloud providers). Since open optical networking is extremely dependent on SDN, the CSPs are less likely to deploy open optical networking.

Considering the importance of fully understanding the needs and motivations of each service provider type, obtaining greater depth and granularity of market intelligence on each of the scenarios of deployment in each of the service provider categories is of high value in roadmap and customer/market engagements planning.

Click for more information about Rick Talbot. Contact him at rtalbot@acgcc.com.

[1] An alien wavelength is an optical signal between transponders sourced from a different vendor than that of the optical line system.