Communications Software (CommSoft) comprises:

- Business Support Systems (BSS) that provide business operations support (revenue management, customer management, partner management, and business governance)

- Operational Support Systems (OSS) that provide network support (service assurance, network engineering, resource and service provisioning, security, and network governance)

- Virtualized Network Functions (VNF) and their orchestration provided by software running on cloud infrastructure.

- A full review of the state of CommSoft with my predictions is available as a part of the CommSoft Research stream subscription service. Contact the author at mmortensen@acgcc.com or sales@acgcc.com for more information.

Oracle Communications: Split into Two Units

Oracle Communications, the Business Unit formerly led by Doug Suriano, comprised both the equipment (virtual and physical) and the software applications (BSS and OSS with the CX products in its own cross-vertical organization). These have now been split into separate apps (OSS, BSS and Digital Experience for Comms, DX4C)) and equipment business units with their own senior VPs: Jason Rutherford, Senior VP and GM of the Oracle Communications Applications Business Unit and Andrew Morawski, Senior VP and GM of Oracle Communications Global Business Unit now run their own separate organizations.

My Take: This is not much of a change from the last few years. The split between the two areas was done several years ago within the Communications GBU. This represents a change in the particular managers more than a change in direction. Cross-vertical platforms layered with vertical-specific configurations, offerings, and products require complex organizations. I expect the organizational structure to evolve over the next few years.

Oracle All the Way Down, but Multi-Cloud Is a Reality

There were many references during #OOW19 about “Oracle on Oracle” in various forms. Oracle’s strategic position is to provide Oracle applications software on an Oracle technology base (for example, Oracle Linux) on the Oracle Bare Metal Cloud. But with 75% of enterprises that use IaaS doing so on multicloud architectures, the reality is that Oracle cannot dictate that. The announcement of the agreement between Oracle and Microsoft to provide multi-cloud architecture for Azure and the Oracle Cloud is one example, supporting arrangements such as Oracle applications running on an Azure Cloud with an Oracle Exadata back end running Oracle Autonomous Database on the Oracle Bare Metal Cloud is just one example of these complex multicloud arrangements.

My Take: This is a very practical approach, as usual for Oracle. Multicloud is here to stay and will be the dominant way that computing and virtualized networking , are supported in the future.

Movement to the Cloud: Still a Key Imperative, but the Approach Is More Practical

Oracle is aggressively moving its leading products to the cloud with its virtualization/containerization and infrastructure automated orchestration. The Oracle BRM system is now available in a cloud native form, and its CX products have been available as SaaS on the Oracle Bare Metal Cloud for some time. But Oracle’s former statements about aggressively moving all its comms applications to cloud-native technology have been tempered by reality. Existing noncloud systems are being supported and evolved while the move to microservices in BRM and others is a measured move with course-grain APIs (a few large microservices) being implemented first with potential rearchitecting to smaller, more numerous microservices in the future.

My Take: This approach fits the market realities for the CSP market. In the last five years, CSPs’ investments in on-prem systems have been huge in both BSS and OSS. Most CSPs were not about to abandon these recent upgrades for the sake of an Oracle cloud solutions.

Moving to Ubiquitous Automation for Its Technology Infrastructure

For the Oracle database and now for Oracle Linux, Oracle has automated the patching, implementation and configuration of the technology to an unprecedented degree. Oracle touts the benefits of automation in reducing labor costs, decreasing errors, and securing the systems.

My Take: The Oracle Autonomous Database and now Oracle Autonomous Linux represent a significant advance in the usability and security of the systems. This kind of ubiquitous automation should, and probably will be, applied to all the technical areas for communications, including NFV and communications networking, in general.

BSS Strategy of Cross-Industry Cloud Platforms: Maturing

Oracle has found that the requirements for many systems are very similar in multiple industries. It has been moving to cross-industry (aka, cross-vertical) platforms that serves most of these needs. Two key areas relevant to CSPs are in CX (customer care) and BRM (revenue management). In the former, this has allowed the advances from the enterprise market to be applied to the CSP market while in the latter, the more complex offerings and subscription model has been arbitraged from the CSP to the enterprise market. Now that the basic platforms are in place (in the cloud), Oracle is turning its attention more to verticalized packages for specific industries. Oracle’s #OOW19 announcement of its Digital Experience for Communications (DX4C) is an example of that. It incorporates many communications industry-specific features and standards, such as the use of TM Forum APIs and data models.

My Take: This is the normal maturation process for cross-vertical offerings and represents an inevitable evolution of the Oracle business in these areas. It shows Oracle’s continuing strong commitment to these market areas.

Siebel Forever Strategy: In Play More than Ever

Oracle’s announcements, or lack thereof, had seemingly indicated adopting a strategy that Siebel would be replaced (in the undefined but near future) with the new cloud-based offerings but without having a well-articulated migration strategy. The reality of Siebel running long into the future became part of Oracle’s mantra at #OOW18, which I described as Siebel Forever. Oracle has now gone beyond the former basic plan of using Siebel as a database of record and quickly migrating all the functionality to the cloud-based offering and, instead, will be supporting Siebel more aggressively into the future.

My Take: I understand that the revitalization of the Siebel roadmap has led to new sales of the system in the CSP market. It is a more practical approach for a complex system that is so difficult to forklift out of the operation.

SaaS Commitment: Unwavering but Less Strident

Oracle as a company has gone all in on SaaS for its cloud-based products. This has continued, although it is not so strident about pushing its customers to the SaaS cloud-based solutions as they were last year at #OOW18 and the year before. Oracle’s new approach is more measured for those CSPs not yet ready to make the cloud transition, for both legacy systems and new systems.

My Take: This is a good change in attitude. Cloud-based systems (mostly hybrid cloud) will dominate in the future. But many CSPs are not ready to make the cloud transition, much less to SaaS (which will have financial model implications for CFOs). And CI/CD is a far-off dream for some CSPs for many of their systems.

Digital Experience Is Broadening to Include CSP Employees

The industry has focused on implementing a streamlined, much-desired digital experience for the CSP consumer customers. Oracle has followed the CSP interest in these areas. But little had been done by vendors to make major improvements in the digital experience of the employees. Oracle’s announcement of its DX4C and its several component offerings takes Oracle into this new area.

My Take: This is a significant move to bring digital innovation into the CSPs’ operations that require the application of human intelligence, augmenting it with artificial intelligence and process automation. More work will also need to be done in the future for the digital experience for CSPs’ enterprise customers and for the CSPs’ ecosystems partners.

Design-Time Product Catalog Is an Area of Innovation for BSS

Oracle’s newly-announced DX4C includes a new offering of a product catalog (the Enterprise Catalog for Communications) that is an off-line or design-time catalog used during the new product creation and introduction process. Doing much more than previous catalogs, it helps the designers quickly target, create, design, fine-tune, and implement new products. It is architected to be able to work with the Oracle on-line systems or to augment existing systems, publishing the resulting catalog entries in the existing product catalogs.

My Take: This represents a significant innovation. It takes the area of Product Lifecycle Management pioneered by Tribold (now part of Sigma Systems) and enhances it with significant AI and data capabilities to match the right services to the right markets using Oracle and third- party-supplied data on consumers and businesses.

CSP BSS Competition Will Shift from Feature/Functionality to Market Places and Data

BSS competition has been based on features and business functionality for business operations. This is expanding into new areas, particularly in two areas: The first is zero-touch partnering for a CSP’s ecosystem partners (suppliers and resellers) who are increasingly important to the growth of the CSPs. The second is the incorporation of Oracle-provided and third-party-provided social, demographic, preference and proclivity data about consumers and enterprises that is needed to feed the AI engines.

My Take: This may well change the competitive game over the next few years in the BSS space. I will be carefully following what I perceive as a major trend.

Oracle’s 5G Offerings Focus on the Core with Both On-Prem and SaaS NFV Solutions

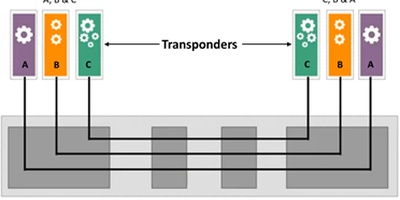

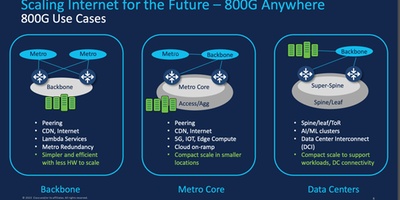

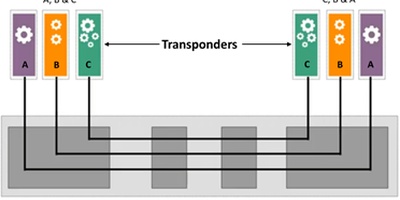

The Oracle 5G solution is focusing on the 5G core, not the radio part of the network, eschewing having an overall 5G solution. Its offers both traditional on-prem architectures as well as SaaS-based virtualized solutions. For the on-prem solutions, where Oracle has a strong product line in the signaling area, it is partnering with others for the user plane components in a pre-CUPS architecture and has successfully demonstrated calls on a multivendor standalone 5G core architecture. For the NFV solutions, it has adopted a containerized approach with a modern service mesh and will be offering Slicing-as-a-Service running on the Oracle Bare Metal Cloud.

My Take: Leaving the radio portion of the 5G networks is a good move—it is far away from Oracle’s core competencies. Still unknown is how the CSPs will “chunk out” their RFPs for 5G networks. Will they want an overall solution? Will they separate out the radio from the core? Will they separate the 5G into the control and action planes using the CUPs architecture, and if so, when? What will be the uptake of on-prem vs. NFV solutions? And how popular will Slicing-as-a-Service be for various use cases, especially IoT? ACG Research believes that most CSPs have a moderately strong desire for an overall solution but that many will use separate vendors for the radio and core parts of the network. As to multivendor architectures within the core and within a disaggregated radio solution, the standards are nascent, and the market timing and uptake is still unknown.

I will be researching these questions over the next year with my colleague, Chris Nicoll.