Software-defined wide area networking (SD-WAN), a promising new technology that brings optimization, visibility and flexibility into the WAN environment, has been experiencing significant growth. Our research shows that the top use cases for SD-WAN are Internet connectivity to cloud-based applications, hybrid WAN, visibility and application-based routing and branch connectivity and performance.

However, despite its significant potential, SD-WAN is somewhat misunderstood, and there is some confusion in the marketplace about the true size of revenue associated with SD-WAN.

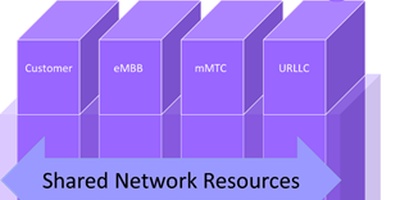

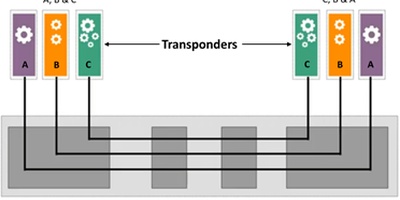

Today, SD-WAN is often considered a VNF, resulting with SD-WAN revenue being lumped with VNF revenue; this is inaccurate. We view SD-WAN as a platform for innovation on top of which current and future VNFs are layered, enabling the modern enterprise to service chain capabilities, such as stateful firewall and WAN optimization. Therefore, we track SD-WAN revenue separately from VNF revenue.

The confusion about SD-WAN revenue stems in part from the vendors’ go to market strategy. Today, SD-WAN (and also VNF) vendors sell either directly to the enterprise (DIY) or to service providers that add services and offer it as a managed service (with various levels of management) to the enterprise. This may lead to double counting of some revenue, as revenue from service providers is sometimes added to vendors’ revenue.

To mitigate any confusion, we follow a thorough methodology in tracking SD-WAN and VNF revenues across various market segments. We segment the market as follows:

Figure 1. SD-WAN and VNF Revenue Segmentation

Although the DIY segment started out strong, it is losing momentum against the service provider segment as enterprises take stock of the complexity of bringing SD-WAN in their networks and managing it. SD-WAN is not a set and forget platform; in order to maximize its benefits, the enterprise has to constantly work on optimizing to gain full benefits. This makes SD-WAN better suited to service providers, given their capabilities in offering managed services.

Note that we do not total SD-WAN and VNF revenues across vendors and service providers, because we would be double counting.

Table 1. SD-WAN and VNF and CAGR

Vendors’ market share and revenue size depends on the customer segment. For example, Nuage Networks has the largest market share (25%) in the service provider segment but is eighth in the enterprise market with only 3.6% market share. Conversely, VMWare is the market leader in the DIY segment with about 20% market share but is third in the service provider segment with about 11% market share. It is worthwhile noting that the market is still fragmented with many players vying for market share. As the market develops and matures, it is expected that clear winners will emerge, and further consolidation will occur.

These highlights are extracted from the first SD-WAN and VNF market report ACG recently introduced. The report analyzes the market in great depth, provides a dashboard that enables viewing of revenue at a country level and at a vertical level. The report is issued bi-yearly; in each release, two service providers are highlighted. The introductory report spotlights Comcastand Masergy, two innovative providers of SD-WAN managed services.

Table 2. SD-WAN Vendor Revenue and Market Share

Liliane Offredo-Zreik and Ray Mota are principal analysts with ACG Research, covering SD-WAN.

For more information about purchasing this report or a yearly subscription, contact Karen Grenier, kgrenier@acgcc.com.