I attended the 5G Analyst Meeting in Dallas, TX, sponsored by 5G Americas on 19−20 October 2022. I focused my attention on O-RAN and AI. Here are some of the highlights of what I heard and my opinions.

5G Is Now Real in the Americas

In the past 3 years, 5G worldwide has gone from 38 networks to 233 networks and from 1.5M subscribers to 813M subscribers. In the Americas, two-thirds of the geography and population are now covered by mid-band 5G, with a 31% CAGR subscriber growth. 5G users consume 2.5 to 3 times the data of 4G customers and do twice as much streaming as LTE users.

Fixed wireless application is at 2.2M subscribers and expected to grow to 10M by 2026. However, some participants wondered if this is a temporary situation, while the MNOs look to maximally use their available capacity during the early subscriber growth.

Expected Applications of 5G

5G is not able to command a premium price, despite a higher data rate, so monetization has to come from new use cases that create efficiencies in enterprises. This will require that 5G get a portion of the pie that others in the enterprise market currently have.

Speakers described how although enterprise users have mostly been targeted for 5G applications the consumer market should not be overlooked. They described the set of uses:

Consumer | Enterprise |

Faster data | Manufacturing |

Wearables | Utilities |

Gaming | Teams |

Social communication | Healthcare |

Metaverse | Finance |

IoT | Smart cities |

Navigation | Media & entertainment |

Education | Education |

Sports | Retail |

AR/VR is expected to be driven in the enterprise space and arbitraged into the consumer space.

5G Evolution

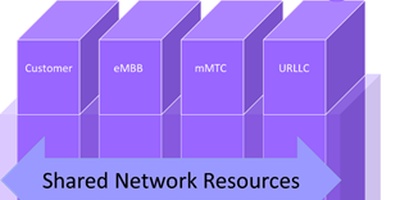

Slicing

Slicing capabilities are in place and will be used internally in FWA and MVNO and some external use cases such as low-latency gaming. CSPs have orchestration capabilities in place for static use cases, dynamic will follow. There seemed to be no thoughts about inter MNO cooperation on slices that transcend their boundaries.

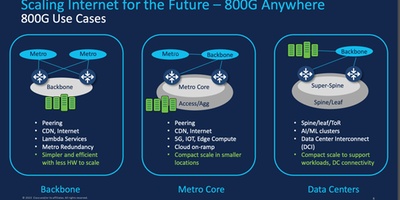

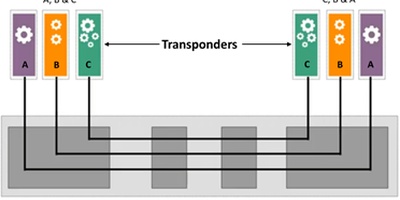

Backhaul Capability

Will this be a chokepoint? Not with the fiber deployments happening. AT&T described how it views 10 Gbps backhaul as standard, with 100 Gbps in special places. However, in rural areas, point-to-point microwave has bandwidth issues.

Comparing 3G-4G and 4G-5G Evolution

The 3G to 4G evolution was driven by less expensive mobile data, which drove a smooth transition. 4G to 5G has marginal capacity enhancement unless new spectrum is allocated. Ubiquitous mid-band coverage is the pacer for the advanced use cases. However, Massive MIMO in Release 18 and 19 will help spectral efficiency, and AU/ML automation control will help manage capacity more efficiently with respect to spectrum and energy usage.

Low-power IoT should stay on LTE for a long time.

FCC: Spectrum Allocation and O-RAN

The FCC will be making changes to the spectrum allocation process to speed it up. It will set high-level goals and use an NTIA-based process, while probably expanding the commercial spectrum reallocation fund to allow equipment changed out due to reallocation to be later technology than what is being replaced.

O-RAN is viewed by the FCC as a way for US companies to enter the market.

O-RAN Uptake Is Happening, but Slower than Expected

- There was general consensus that O-RAN uptake has not been as fast as many expected (several O-RAN vendors in financial difficulty).

- There was no consensus on how fast or how much of the RAN market will be O-RAN. Several speakers quoted “an analyst” estimating 30% uptake by 2030, but no one seemed to agree as to what the actual definition of O-RAN to what this was applicable or knew whether this referred to 30% market penetration by 2030 or 30% of 2030 RAN sales.

- There was general agreement that there are three aspects to O-RAN, with different uptake rates:

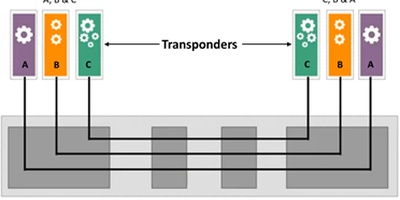

- Virtualized RAN, where the RU is separated from the CU/DU, which is run on commodity hardware with the software running on a general purpose computer, perhaps on a cloud provider. This is proceeding at a fast clip with many examples of the software running on both a telco’s cloud as well as on hyperscalers’ public clouds. Vendors either said that they are already providing these capabilities or that they are O-RAN ready, meaning already abiding by that architecture but not yet integrated with other vendors’ parts.

- Open automation, where the nonreal-time RIC and near-real-time RIC are separated from the underlying hardware and opened for other vendors to provide the software. There are only three use cases in the current 3GPP standards for the nonreal-time RIC, with only a portion of the information and control specified in the standards for more advanced use cases. Further standardization is expected.

- CU/DU separation. The prevailing opinion seemed to be that this will be small until 6G in about 2030.

- There was considerable discussion about the additional cost associated with having to test (and re-test) interoperability between the O-RAN components. No consensus was apparent about the difficulty or the cost.

AI Is of Great Interest with Many Use Cases

AI as a technology is expected to be of great importance, but it is the use cases that are the most important. The major use cases discussed were:

- Spectral efficiency optimization, especially when massive MIMO is deployed,

- Power optimization (the 5G power requirements are massive),

- RF planning,

- AI-controlled slicing with continuous optimization to maintain intent and QoS.

When discussing AI/ML, most mean neural network technology with supervised or unsupervised machine learning, although there are many other types of AI. The evolution toward reinforced learning (where the AI has a set of goals to achieve and adjusts itself continuously) looks interesting.

AI/ML is best suited for those use cases where:

- The volume and/or rate of information exceeds the capabilities of a human,

- Very fast responses are needed,

- The answer does not have to be perfect but approximate to have real value,

- The effect of implementing the AI recommendations are bounded, so black swan events should not happen.

The (weak) consensus was that semi-closed loop operations will be the norm for all but specific use cases. To move to full closed-loop operations will probably require:

- Digital twins and sandboxes for simulating the effects of the AI recommendations,

- Explanation AI (XAI) for providing managers and technicians with the reasons for the recommendations (this is currently a DARPA project),

- A structure and set of policies for guiding the AIs for reinforced learning and ring-fencing the actions of the AIs,

- An overlay that looks at the multiple AIs that are continuously trying to optimize individual parts of the network and services and coordinates their activities in some way, providing intent-based automation.

For more information, contact Mark Mortensen at mmortensen@acgcc.com.